WHAT WE OFFER

One2go insurance offers our unique price comparison system. We are an independent insurance broker and not tied to any one company. We can offer the cheapest up to date prices available. Our system constantly searches the market looking for any changes in price and comparing over 30 insurance companies. We pride ourselves on the best and cheapest prices about..

We have a personal service via email, WhatsApp or Line and this can be accessed directly from your phone or computer, using the QR codes or the email address provided.

WHAT WE REQUIRE

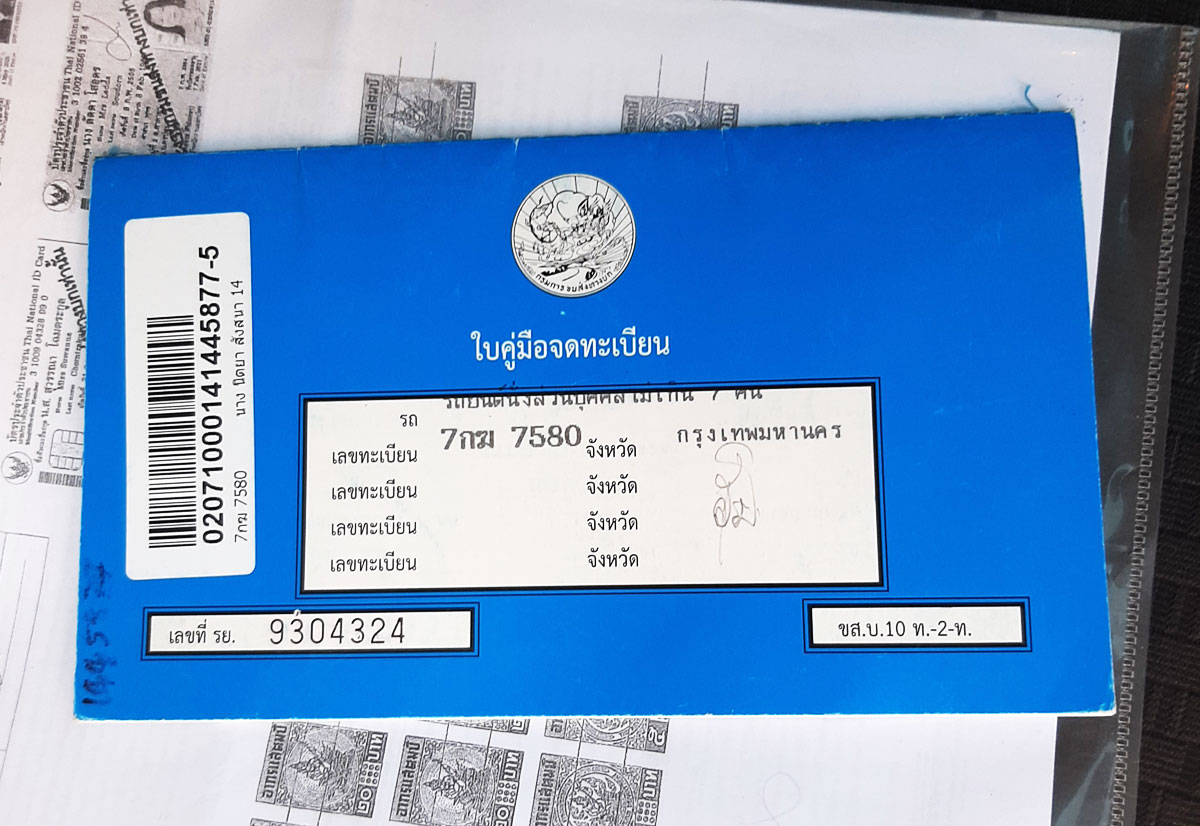

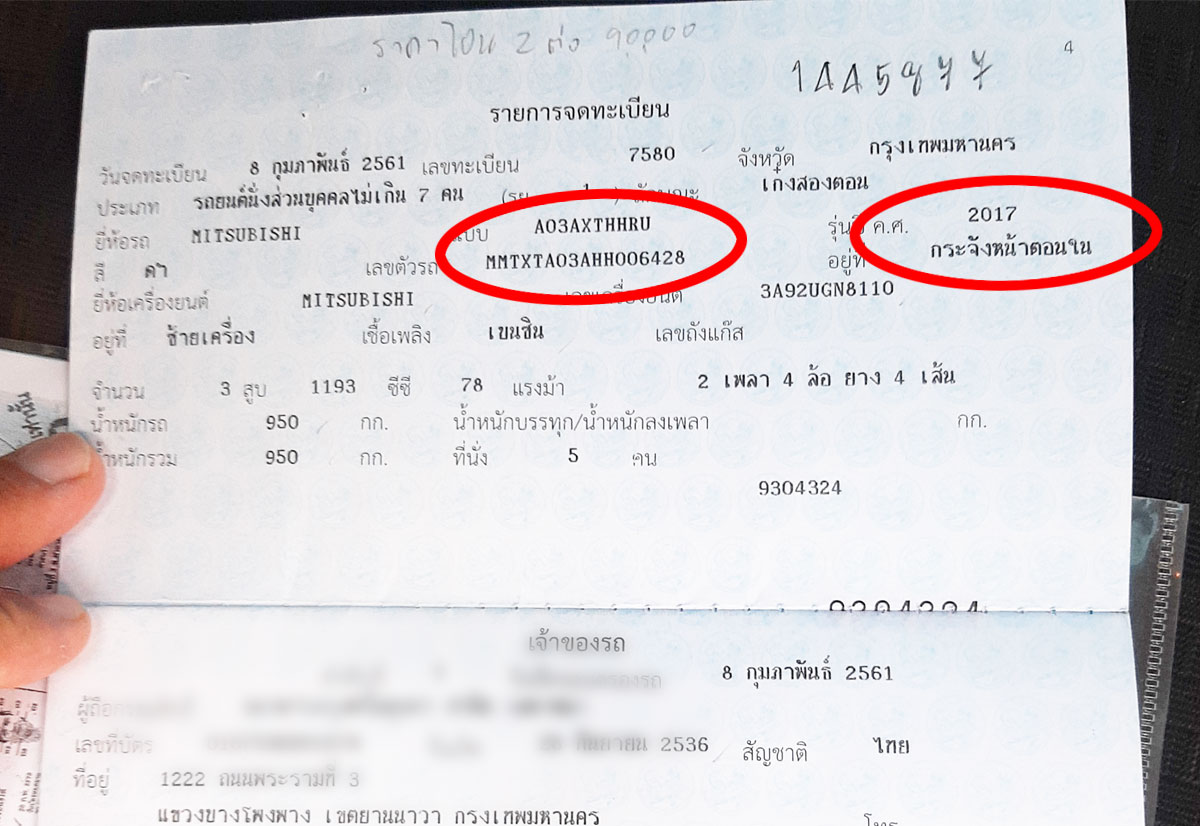

We require a photo of your Blue Book clearly showing the chassis number, year of manufacture. Then tell us you Make, Model, Milage of your vehicle. Our system will search for the best deal available and we will message you back a list of price comparisons and companies.

PAYMENT & COVER

Once you have decided on the best suited policy that fits your requirements and budget, let us know and we will instruct you on payment options.

Once payment has been received, we will issue a copy of the cover note via email and the original documents and policy cover note will be posted to you within 30 days.

AFTER PAYMENT

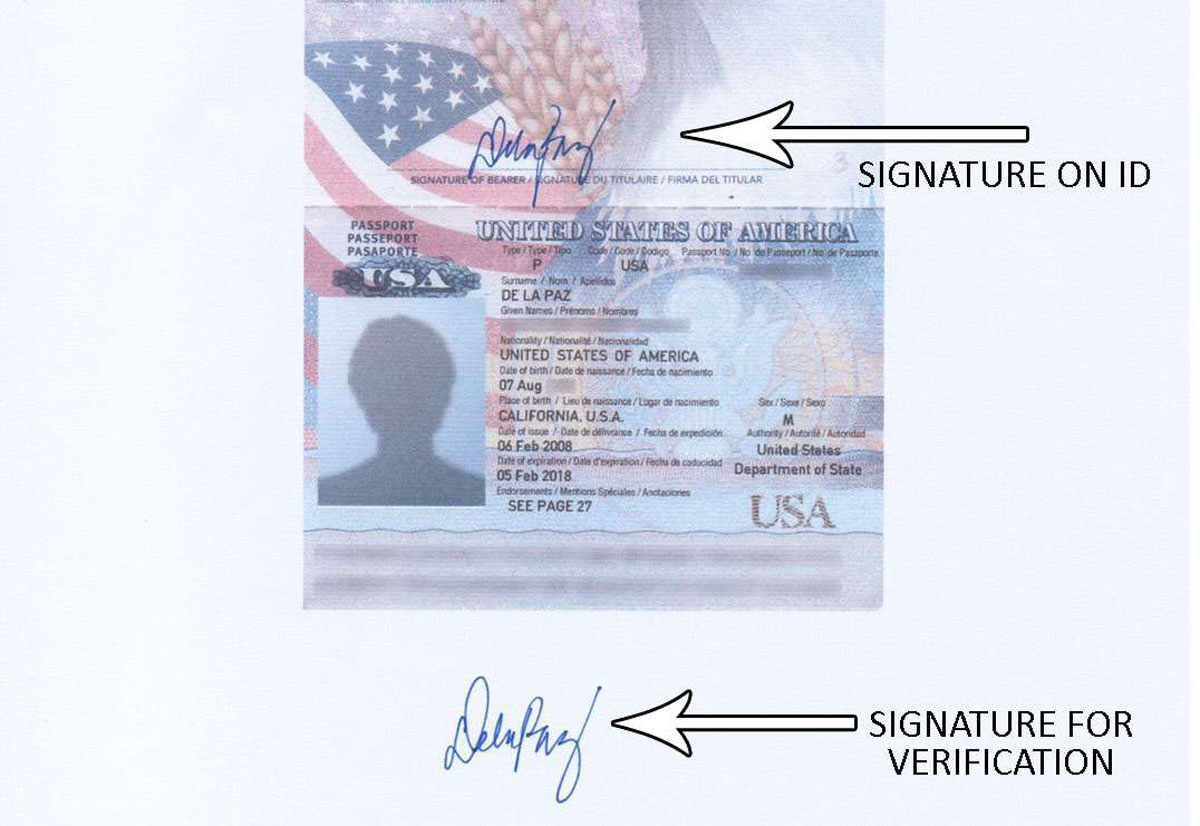

We will require 4 photos of your car, front, sides and back views and a signed copy of your Passport or Thai ID.

NOTE: Some insurance companies will ask for a viewing or inspection of your car, we will advise and arrange all this for you.

NOTE: Some insurance companies will ask for a viewing or inspection of your car, we will advise and arrange all this for you.

CLICK ON THE ICON OR SCAN WITH YOUR PHONE!

+

Clients

+

Policies

+

Claims

9/10

Service Ranking

CAR INSURANCE

Protecting yourself from any unforseen traffic related accidentsEASY STEPS TO BUY CAR INSURANCE.

EVERYTHING CAN BE DONE ON-LINE.

• Use the contact QR codes or email provided.

• Send a photo of your blue book, clearly showing your chassis number, year of manufacturer.

• Inform us on your manufacturer, model, milage (Kilometers) and your estimated value.

• We will be in touch with you with some price comparisons.

• Choose the best policy

• Pay the premium via bank transfer (send proof of payment/photo).

• Submit a signed copy of your Passport or Thai Driving License

A FEW MORE DETAILS ARE REQUIRED.

• Submit photos of your car, front, back and both sides.

• The original documents (policy) will be sent to your mailing address within 30 days.

• You are covered.

CAR INSURANCE

Here in Thailand, there are 4 different classes of insurance, class 1, 2+, 3+ and 3 with class 1 being the best. When choosing you should consider what works for you and the age and value of your vehicle. There are 2 other options to consider with regards to where you choose to have your vehicle repaired, in a main dealer garage or an independent garage (dealer or garage). Your choice here will affect the overall premium paid. There may be a deductible (known in Europe as an excess) on the policy chosen, this is a discount for a specific amount. When making a claim you will be asked to pay this first before repairs are commenced.

฿1750Yearly